|

The beneficiaries of the Charles Reed Bishop Trust reflect what Bishop and his wife valued profoundly; Christian education, support for indigent Hawaiians, and caring for and protecting Hawaiian history, culture and antiquities.

Guided by the core values shared by the Bishops, the mission of the trust is focused on achieving greater sustainability for the trust's beneficiaries.Guided by the core values shared by the Bishops, the mission of the trust is focused on achieving greater sustainability for the trust's beneficiaries. The beneficiaries named in the trust deed include several educational and religious organizations and purposes. The beneficiaries include: the Royal Mausoleum at Mauna‘ala, which houses the remains of Ke Ali‘i Pauahi, Charles Reed Bishop and many significant Hawaiian royalty; and the Bernice Pauahi Bishop Museum, which Bishop named after his wife, Pauahi, as a permanent memorial to her. Other named beneficiaries receive smaller amounts of support, including Mid-Pacific Institute, Lunalilo Home, Kamehameha Schools and several Honolulu churches. Mission, vision and valuesMissionThe mission of the Charles Reed Bishop Trust is to increase the long term sustainability of Mr. Bishop's beneficiaries through coordinated giving and support. Vision The vision of the Charles Reed Bishop Trust carries forth Mr. Bishop's civic generosity and his desire, in life as in death, to perpetuate the shared values, legacy and memory of Pauahi, his wife, whom he held so dear. The Charles Reed Bishop Trust values:

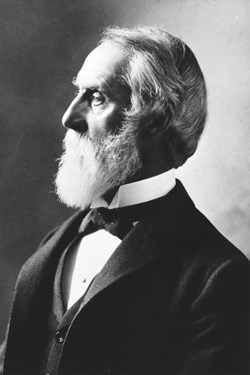

Trust management organizational structureAt the request of Charles Reed Bishop, Kamehameha Schools trustees also serve as trustees for the Charles Reed Bishop Trust. While Kamehameha Schools trustees are charged with setting policy, CRBT trustees are involved in both policy and operational issues.Kamehameha Schools staff members serve on a CRBT Operations Team, which is led by a trust coordinator. The Operations Team includes representatives from Kamehameha's investment, legal, communications, budget and educational departments. CRBT reimburses Kamehameha Schools for the time spent by staff members on CRBT issues. Prior to 1999, CRBT was managed by the Financial Assets Division of Kamehameha Schools. Background of the trustCharles Reed Bishop established his trust on Aug. 1, 1895 (as amended and supplemented by seven subsequent deeds), to create sustainability for several significant endeavors that he pursued in Hawai‘i.Originally from Glens Falls, New York, Bishop came to Hawai‘i in 1846 as a young man. He soon met and happily married Ke Ali‘i Bernice Pauahi Paki, the last direct descendant of King Kamehameha I, and went on to become a well-respected and influential businessman. Of simple beginnings, Bishop valued careful business management and planning, and shared his wife’s vision for greater well-being of the Native Hawaiian people. His work and civic contributions were much-valued by the Hawaiian Kingdom and business community. Some of the noteworthy accomplishments of this respected philanthropist included establishing what is now First Hawaiian Bank, the Bernice Pauahi Bishop Museum, the Bishop Home in Kalaupapa for young girls afflicted with Hansen’s Disease, and his key role in the establishment and growth of Kamehameha Schools Bishop Estate, to name but a few. Trust resourcesThe original endowment of the Charles Reed Bishop Trust began in 1895 as 14 promissory notes with a total value of $800,000. The proceeds of the notes have been reinvested, and over the years the endowment has grown consisting of cash, cash equivalents, marketable securities and other assets.Over the years, the trust has distributed millions of dollars to its beneficiaries. Between 1984 and 2006, the trust awarded more than $5.3 million to its beneficiaries. As of June 30, 2009, the trust was valued at $12.1 million. Investment policyThe Charles Reed Bishop Trust has instituted an investment policy to preserve the real (inflation adjusted) purchasing power of its corpus, maximize funds available for distribution to the beneficiaries over the long term, and grow distributions at least as fast as inflation over the long term.The investment return objective is to earn an average annual real return of equal to or greater than 5 percent net of investment related expenses, based on the Consumer Price Index (CPI) for All Urban Consumers (CPI-U). In meeting the investment return objective, returns are measured based on total returns; that is, the return achieved through income (interest and dividends) and capital appreciation. The actual investment return should exceed the policy benchmark over rolling five-year periods. Spending policyThe Charles Reed Bishop Trust has a spending policy to maximize the amount of distributions to the beneficiaries, minimize administrative and investment costs as prudent to meet the needs of the beneficiaries and to maintain the real value of the endowment in perpetuity.The spending objective is an annual target spending rate of equal to or less than 5 percent based on the average market value of the Trust’s assets over the preceding 12 quarters. Actual spending may vary from year to year because of market value changes and/or beneficiary needs, but on average the Trust will seek to achieve a level at or below 5 percent. Furthermore, while the spending policy provides for a range of 0 percent to 5 percent, the target spending rate is 5 percent. Asset allocation policyThe Trust invests in a passive equity and fixed income portfolio.

|

|